Best SaaS accounting software includes QuickBooks Online, Xero, and FreshBooks. These platforms offer robust features for small to medium businesses.

Selecting the right SaaS accounting software is crucial for your business’s financial health. QuickBooks Online stands out for its comprehensive features and user-friendly interface. Xero offers excellent integration capabilities and scalability, making it ideal for growing businesses. FreshBooks is known for its invoicing and time-tracking features, perfect for freelancers and small enterprises.

Each of these platforms provides essential tools like expense tracking, payroll management, and financial reporting. Choosing the best software depends on your specific needs, budget, and business size. With these options, managing your finances becomes more efficient and streamlined.

Table of Contents

Key Features

Choosing the best SaaS accounting software can be overwhelming. But, knowing its key features can help. Let’s explore the must-have features of these tools.

Automated Invoicing

Automated invoicing saves time and reduces errors. It helps create, send, and track invoices. It also sends reminders for due payments. Automated invoicing can integrate with payment gateways. It ensures faster payment collection. This feature increases your business’s cash flow.

Expense Tracking

Expense tracking is crucial for managing costs. It helps monitor all business expenses. You can categorize expenses for better understanding. It also allows uploading receipts and bills. This feature provides real-time insights into spending. You can identify areas to cut costs and save money.

Financial Reporting

Financial reporting is vital for business health. It helps generate various financial reports. These include profit and loss, balance sheets, and cash flow statements. You can customize reports to suit your needs. Financial reporting ensures compliance with accounting standards. It provides a clear picture of your financial status.

| Feature | Benefits |

|---|---|

| Automated Invoicing | Saves time, reduces errors, increases cash flow |

| Expense Tracking | Monitors costs, categorizes expenses, real-time insights |

| Financial Reporting | Generates reports, ensures compliance, clear financial picture |

Top Saas Accounting Software

Small businesses need reliable accounting software. SaaS accounting software offers many features. Here are the top choices for small businesses.

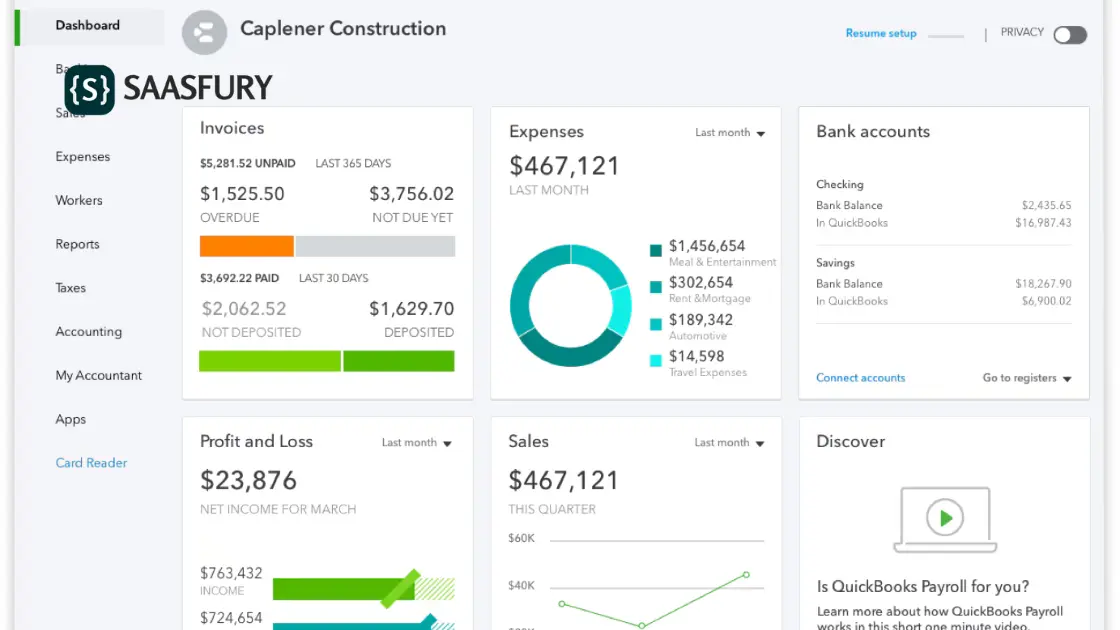

QuickBooks Online

QuickBooks Online is a favorite among small businesses. It offers a user-friendly interface. It has powerful features like invoicing, expense tracking, and payroll management.

- Easy to use

- Automated reports

- Seamless integration with banks

QuickBooks Online supports multiple users. It provides excellent customer support. This makes it a top choice for many.

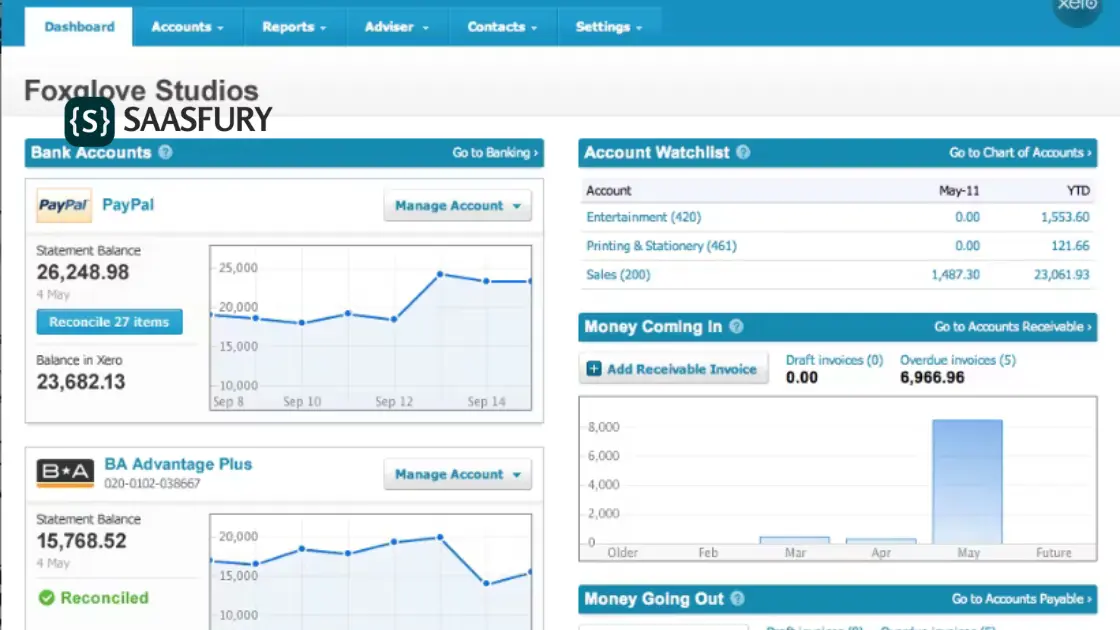

Xero

Xero is another top SaaS accounting software. It is known for its strong features. It provides real-time updates and integrates with over 800 apps.

- Real-time financial data

- Mobile app for on-the-go access

- Multiple currency support

Xero is great for collaboration. It allows multiple users to work simultaneously. This is ideal for growing businesses.

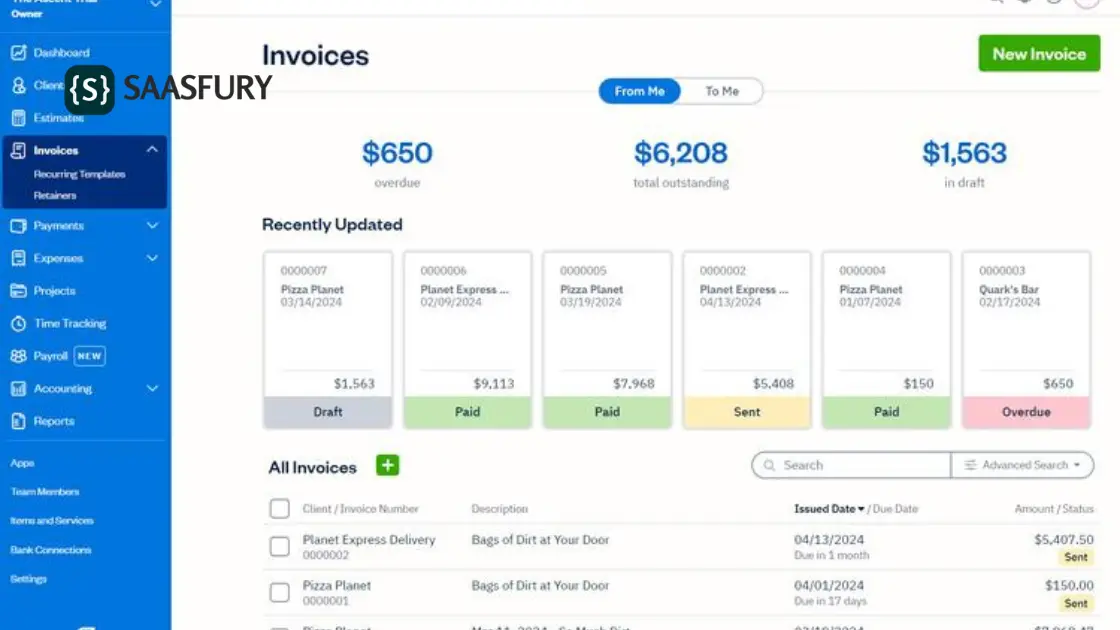

FreshBooks

FreshBooks is perfect for freelancers and small businesses. It offers easy invoicing and expense tracking. It also supports time tracking and project management.

- User-friendly interface

- Time tracking features

- Customizable invoices

FreshBooks offers excellent customer support. It is a great choice for those needing simple, effective accounting tools.

Benefits Of Saas Accounting

Switching to SaaS accounting software can revolutionize your business’s financial management. SaaS offers numerous benefits that make accounting seamless and efficient.

Cost Efficiency

SaaS accounting software often operates on a subscription basis. This means you avoid hefty upfront costs. Instead, you pay a predictable monthly fee. There are no hidden charges for updates or maintenance. This makes budgeting easier for businesses of all sizes.

Traditional software may require expensive hardware. SaaS eliminates this need. You also save on IT staff costs, as the provider handles maintenance. Overall, SaaS offers a cost-effective solution for accounting needs.

Scalability

As your business grows, your accounting needs will change. SaaS accounting software can easily scale with your business. You can add more users or features as needed. No need to purchase new software.

Scalability ensures that the software grows with you. Whether you are a startup or an established business, SaaS can meet your needs. This flexibility is a key advantage of SaaS accounting software.

Accessibility

SaaS accounting software is accessible from anywhere with an internet connection. This means you can work from home, in the office, or on the go. You only need a device and internet access.

Cloud-based access also ensures that your data is always up-to-date. Multiple users can access and update information in real-time. This improves collaboration within your team. You can also share data easily with accountants or financial advisors.

Accessibility ensures that you always have the information you need. It makes managing finances more convenient and efficient.

Choosing The Right Software

Picking the best SaaS accounting software can be hard. You need to consider many factors. This guide will help you make the right choice.

Assessing Business Needs

First, assess your business needs. Do you need simple bookkeeping or advanced features? List your must-have features.

Consider if you need:

- Invoicing

- Expense Tracking

- Payroll

- Inventory Management

- Reporting

Understand what tasks you need the software to handle. Match these tasks with the software capabilities.

Budget Considerations

Budget considerations are crucial. SaaS accounting software comes with varying costs. Some offer free plans with limited features. Others have premium plans with all features unlocked.

Compare the costs:

| Software | Free Plan | Basic Plan | Premium Plan |

|---|---|---|---|

| Software A | Yes | $10/month | $30/month |

| Software B | No | $20/month | $50/month |

| Software C | Yes | $15/month | $40/month |

Ensure the software fits your budget and business size. Look for discounts or annual plans for savings.

User Reviews

User reviews are a goldmine of information. Read what other users say about the software. Look for reviews on:

- Ease of Use

- Customer Support

- Feature Set

- Reliability

Check multiple review sites for a balanced view. Consider both positive and negative reviews. Users often highlight the pros and cons that you might miss.

Integration Capabilities

In today’s fast-paced business world, integration capabilities in SaaS accounting software are crucial. Seamless integrations simplify workflows and improve productivity. Let’s explore key integration features.

CRM Integration

CRM integration connects your accounting software with your customer relationship management system. This ensures all customer data is synchronized. It helps in tracking sales and managing invoices. Here are some benefits:

- Improved customer data accuracy

- Streamlined communication

- Better sales forecasting

Popular CRMs like Salesforce and HubSpot offer easy integration with top accounting software.

Payment Gateways

Integration with payment gateways ensures faster payment processing. It reduces manual entry errors. It also improves cash flow. Key benefits include:

- Automated invoice generation

- Real-time payment updates

- Enhanced security

Leading payment gateways like PayPal, Stripe, and Square integrate seamlessly with many accounting platforms.

Third-party Apps

Integrating with third-party apps enhances functionality. It offers a more comprehensive solution. Some popular third-party app categories include:

| Category | Examples |

|---|---|

| Project Management | Asana, Trello |

| Time Tracking | Harvest, Toggl |

| Email Marketing | Mailchimp, Constant Contact |

These integrations simplify tasks and improve efficiency. They make your accounting software more powerful and versatile.

Security And Compliance

Security and compliance are crucial for any SaaS accounting software. Your financial data needs protection. Here, we will explore the key aspects of security and compliance.

Data Encryption

Data encryption ensures that your financial data is safe. Encryption converts your data into a code. Only authorized users can read this code. Modern SaaS accounting software uses strong encryption methods. This protects your data from hackers.

| Encryption Method | Protection Level |

|---|---|

| SSL/TLS | High |

| AES-256 | Very High |

Regulatory Compliance

Regulatory compliance ensures your software meets legal standards. Compliance protects you from legal issues. Most SaaS accounting software complies with major regulations. This includes GDPR, HIPAA, and SOX.

- GDPR: Protects data of EU citizens

- HIPAA: Ensures health data privacy

- SOX: Protects against corporate fraud

User Permissions

User permissions control who can access your data. Set different permission levels for different users. For example, admin, manager, and employee levels. This protects sensitive data from unauthorized access.

- Admins: Full access

- Managers: Limited access

- Employees: Basic access

Using user permissions ensures data safety. Only authorized users can access important data.

Customer Support

Customer support is vital for any SaaS accounting software. Users need help to solve issues quickly. Great customer support ensures smooth operations.

24/7 Support

Having 24/7 support is crucial for accounting software. It ensures users can get help at any time. This feature is especially useful for global businesses.

| Provider | 24/7 Support |

|---|---|

| Software A | Yes |

| Software B | No |

Community Forums

Community forums offer a space for users to share experiences. These forums are rich with user-generated tips and solutions. They are great for learning from peers.

- Find answers to common issues

- Get advice from experienced users

- Share your own tips and tricks

Training Resources

Training resources are essential for mastering the software. These resources include video tutorials, guides, and webinars. They help users understand the software better.

- Video Tutorials

- Step-by-Step Guides

- Interactive Webinars

Quality training resources boost user confidence and productivity. Make sure the software you choose offers comprehensive training.

Future Trends

The world of SaaS accounting software is evolving rapidly. Future trends are shaping how businesses manage their finances. Let’s explore the upcoming advancements in this dynamic field.

Ai And Automation

Artificial Intelligence (AI) and automation are revolutionizing accounting software. These technologies streamline processes, reducing manual effort.

AI can predict financial trends. It helps businesses make better decisions. Automation handles repetitive tasks, saving time and money.

- Automated invoicing

- Expense tracking

- Data entry

These features enhance efficiency and accuracy in financial management.

Blockchain Integration

Blockchain technology is becoming integral to accounting software. It offers secure and transparent transactions.

Blockchain ensures data integrity. It prevents unauthorized access and fraud.

| Benefits | Details |

|---|---|

| Security | Encrypted transactions and data |

| Transparency | Immutable records |

| Efficiency | Faster transaction processing |

These advantages make blockchain a valuable addition to accounting software.

Mobile Accessibility

Mobile accessibility is crucial for modern businesses. SaaS accounting software must be accessible on mobile devices.

With mobile apps, users can manage finances on the go. They can check balances, send invoices, and track expenses from anywhere.

- Real-time updates

- Ease of use

- Improved productivity

Mobile-friendly software ensures businesses stay connected and efficient.

Conclusion

Choosing the best SaaS accounting software boosts your business efficiency. Evaluate features, pricing, and support to find your perfect match. With the right choice, managing finances becomes seamless and stress-free. Invest time in research to reap long-term benefits. Your business deserves the best tools for growth and success.

Leave a Comment